Get a Tax Certificate Without the Headache: A Comprehensive Guide

Dealing with taxes can feel like navigating a labyrinth. From understanding complex regulations to gathering the right documentation, it’s a process many of us dread. One crucial piece of this puzzle is the tax certificate, a document often required for various financial transactions. But fear not! This guide will demystify the process of obtaining a tax certificate, helping you navigate it smoothly and efficiently, all without the usual stress.

What is a Tax Certificate and Why Do You Need One?

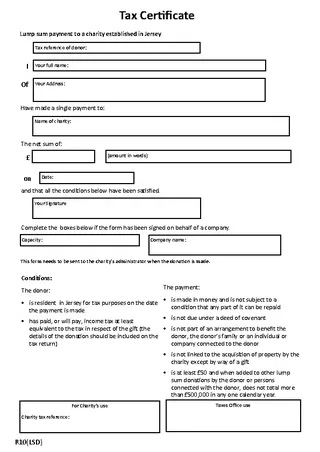

A tax certificate, sometimes referred to as a tax clearance certificate or a tax compliance certificate, is an official document issued by the relevant tax authority in your jurisdiction. It verifies that your tax affairs are in good standing, meaning you’ve either paid your taxes on time or are adhering to a payment plan.

You might need a tax certificate for a variety of reasons, including:

- Securing a Loan: Lenders often require a tax certificate to assess your financial responsibility.

- Government Contracts: Bidding on government contracts usually necessitates proof of tax compliance.

- Business Registration and Renewals: Some jurisdictions require a tax certificate to register or renew your business licenses.

- Property Transactions: Buying or selling property may require a tax certificate to prove all taxes are up to date.

- International Transactions: When dealing with international business, a tax certificate might be necessary to prove compliance with the tax laws of your country of residence.

Understanding the Process: Steps to Obtain Your Tax Certificate

The specific process for obtaining a tax certificate varies depending on your country and local tax authority. However, the following general steps are usually involved:

- Determine the Issuing Authority: Identify the relevant tax authority responsible for issuing tax certificates in your location (e.g., IRS in the United States, HMRC in the United Kingdom, etc.).

- Check Your Tax Status: Before applying, ensure your tax obligations are up to date. This includes filing your tax returns on time and paying any outstanding taxes, penalties, or interest.

- Gather Required Documents: The specific documentation needed will vary. Common requirements include:

- Tax identification number (TIN)

- Proof of identity (e.g., passport, driver’s license)

- Tax returns for the relevant tax periods

- Proof of address

- Business registration documents (if applicable)

- Choose Your Application Method: Most tax authorities offer multiple application methods, including:

- Online Application: This is often the fastest and most convenient method, requiring you to create an online account with the tax authority and submit your application electronically.

- In-Person Application: You can visit the tax authority’s office and apply in person. This method may involve waiting in line and requires physically submitting your documents.

- Mail Application: Some tax authorities allow applications via mail. This process can take longer than online or in-person applications.

- Submit Your Application: Carefully complete the application form, attaching all required documents, and submitting it through your chosen method.

- Pay Any Applicable Fees: Some tax authorities may charge a fee for issuing a tax certificate. Ensure you understand the fees and pay them promptly.

- Await Processing and Collection: Processing times vary. You may receive your certificate electronically or by mail. Keep track of your application status if possible.

Tips for a Smooth Application Process

To minimize potential headaches and ensure a smooth application process, consider these helpful tips:

- Start Early: Don’t wait until the last minute. Allow ample time for processing, especially if you’re applying online or by mail.

- Double-Check Your Information: Ensure all the information you provide on the application form is accurate and complete. Errors can lead to delays or rejection.

- Keep Records: Maintain copies of all your tax returns, payment confirmations, and application documents. This will be helpful if you need to provide additional information or dispute any issues.

- Utilize Online Resources: Most tax authorities have websites with detailed information, FAQs, and online application portals. Use these resources to your advantage.

- Seek Professional Help (If Needed): If you find the process overwhelming or have complex tax affairs, consider consulting a tax professional for assistance.

Navigating Common Challenges

While the process is generally straightforward, you might encounter some challenges:

- Outstanding Tax Liabilities: If you have unpaid taxes, you’ll likely need to resolve them before receiving a tax certificate. Contact the tax authority to discuss payment options or set up a payment plan.

- Incomplete Documentation: Missing or incorrect documentation can delay your application. Make sure you have all the required documents ready.

- Technical Issues: Online application portals can sometimes experience technical glitches. Be patient and try again later or contact the tax authority’s technical support for assistance.

- Long Processing Times: Processing times can vary depending on the volume of applications and the tax authority’s efficiency. Plan accordingly and factor in potential delays.

Frequently Asked Questions (FAQs)

- How long does it take to get a tax certificate? Processing times vary. Online applications are often the fastest (days or even hours), while mail applications can take weeks. Contact your local tax authority for specifics.

- What happens if I have outstanding tax liabilities? You usually need to resolve your tax liabilities (pay them in full or set up a payment plan) before receiving a tax certificate.

- Is a tax certificate the same as a tax return? No. A tax certificate confirms your tax compliance, while a tax return is a document you file to report your income and expenses to the tax authority.

- Can I apply for a tax certificate on behalf of someone else? Generally, you need a power of attorney or authorization to apply on behalf of another individual or business.

- How long is a tax certificate valid for? The validity period varies. Some certificates are valid for a specific period (e.g., 30 days, 6 months, or a year), while others may be valid as long as your tax affairs remain in good standing. Check the certificate’s details for its expiration date.

Conclusion: Take Control of Your Tax Obligations

Obtaining a tax certificate doesn’t have to be a stressful experience. By understanding the process, gathering the necessary documents, and following the tips outlined in this guide, you can navigate this task efficiently and with confidence. Take control of your tax obligations, stay compliant, and enjoy the peace of mind that comes with knowing your tax affairs are in order. Remember to consult your local tax authority’s website or seek professional help if you have any specific questions or require personalized assistance.